Don’t Panic: On the Subprime News for Car Loans, Everything is According to Plan

There has been a lot of headlines spilled this week as the number of Subprime Loans falling behind has increased. However, lost in the hysteria of all our brother car blogs and scary statistics is the fact that, all is going according to plan and that yes, subprime is ‘going back to normal’ after the cash from the pandemic has dried out.

Wolf Richter of Wolf Street reminds us to remain calm. That this is already priced as subprime debt, and that the better performance of subprime during 2020-2022 was fueled by pandemic cash. Now it has completely dried up, therefore the subprime market is returning to expected behavior.

Subprime borrowers, typically those with lower credit ratings, often find it challenging to manage their debts, which is why they are classified as subprime in the first place. Despite the media attention, subprime auto loans represent only about 14% of total outstanding auto loan balances. Most of these loans have been bundled into Asset-Backed Securities (ABS) and sold to investors seeking higher yields.

New vehicle sales, on the other hand, are primarily reserved for prime-rated customers and cash buyers. Delinquency rates for prime-rated auto loans, which make up 86% of auto loan balances outstanding, remain minuscule. Fitch reported a 60+ day delinquency rate of just 0.27% for prime auto loans in September, even lower than pre-pandemic levels.

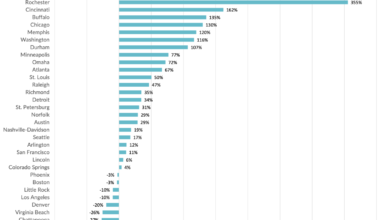

The real concern lies within the subprime segment, where a substantial portion of loans frequently experience delinquency. In September, the delinquency rate for subprime-backed ABS reached a record 6.1%, surpassing previous highs in October 1996 and August 2019.

August 2019! Remember the world at that time? Trump was president, writing lovely letters to Kim-Jong Un of North Korea. It was pre-pandemic life, and back then interest rates for prime used car loans were near 2% and sub-primer borrowers we’re paying probably a somewhat tolerable 16.99% in their car loans. So yeah, don’t panic, this is *the* plan all along. Of course subprime borrowers of car loans would have issues paying back their loans. That’s the point. That’s heading back to normal trends back in 2018-2019. More risk, more reward for the lenders. I’ve heard subprime now starts at 18.99% and can go as high as 24.99% on some predatory car loans at BHPH lots.

During the pandemic, government support and stimulus payments temporarily reduced subprime delinquency rates. However, as subprime lenders became more aggressive and lax in their lending standards, due to better paybacks, some faced financial difficulties in 2023 once the cheap money stopped flowing.

The profitability of subprime lending is alluring for both lenders and investors due to high-interest rates and substantial profit margins on vehicles. These specialized subprime lenders typically offer high-risk, high-interest-rate loans to subprime-rated borrowers, and a significant portion is expected to default. To mitigate this risk, they securitize their subprime auto loan pools into ABS with different tranches, allowing investors to choose their risk tolerance.

Despite the challenges in the subprime market, prime-rated auto loans have remained robust, and their delinquency rates have stayed low. For the subprime market, the return to normal delinquency levels and some subprime dealer-lenders’ failures emphasize the high-risk, high-reward nature of this lending segment. Subprime auto lending continues to be a small yet significant corner of the used-vehicle market, periodically attracting attention due to its inherent volatility and potential for profit.